Sohu.com (SOHU) is one of the leading portals and online game companies in the Chinese Internet market. Its businesses consist of brand advertising, search business where it owns ''Sogou.com'', and online gaming business. Under the online gaming business segment, Changyou.com is another subsidiary it owns. Sohu, along with its subsidiaries, competes in China's internet market among fierce competition. Baidu (BIDU) and SINA are the biggest players in the market for the search engine and Internet information.

Total Returns Comparison

(click to enlarge)

Source: Ychart.com

The chart above compares Sohu's total annual to the S&P 500 index and its peers including Baidu and SINA. When compared to its competitors, the total returns offered by Sohu are impressive. Taking the total returns from the past year into consideration, Sohu provided around 58.57% of returns on every dollar invested by the investors. In this same year, its competitors were miles away from Sohu in terms of providing returns to their investors. In fact, Baidu, the market leader in the search engine business in China, provided negative returns in the past year. This was due to increased investment activities and operating cost. Moreover, Sohu posted more than twice the returns posted by S&P 500 index in the past year. This compelling performance was possible due to strength in the online gaming business and increase in brand ads revenue during the year.

Future performance of the company is not drawn by looking at returns in the past, current business activities also have weightage. Let's find out what activities the company is engaged in currently to generate revenue in the future.

Brand advertising will ramp up

According to Analysys International, Sohu ranked second in advertising sales among online video players in China with 10.3% market share. Its strong financial strength and synergies created from its other online services supports the company's place amongst the leaders. Online video advertising revenue will reach $16.3 billion in 2013 compared to $12.2 billion in 2012. Increased expenditure on online advertisement will drive growth. The tightening TV advertising policies by the Chinese government may help accelerate the shift of marketing budgets to the online video platform.

Going forward, Sohu plans to take advantage of this situation and start monetizing this opportunity in the mobile video platform. The mobile video platform contributes approximately 30% of its total video traffic and has crossed the 100 million customer mark. The company has an excellent opportunity with the airing of the most popular reality TV show ''Voice of China 2'' during the second half of this year. Sohu plans to make this TV show available on its mobile video platform. The pre-selling of ad-slots is observing strong demand from advertisers. It is working with Samsung (SSNLF.PK) for pre-installation of its customized Sohu video application in Galaxy S4 for this event. The management expects Samsung will sell more than 100 million mobile devices including phones and tablets in China over the next three years. In addition, it has a strategic cooperation agreement with China Unicom (CHU) to provide special data packages to promote this application.

This monetization opportunity will result in a revenue boost from advertisements. Sohu reported $80 million of revenue in the first quarter of 2013 for its brand advertisement segment, primarily due to advertisement from the FMCG and Real Estate sectors. The company will observe a rise in advertisers from Hotel, Financial, and Telecom sectors this year. Sohu will route advertisements from these sectors to the mobile video platform. The mobile monetization will aid the company to generate an impressive $397 million of revenue in the fiscal year 2013 for this segment.

Search engine business on its way to growth

Sogou.com, a search engine subsidiary of Sohu, continues to progress based on monetization of its search and web directory traffic. According to the company, paid search sales surged by 67%, year-over-year, to $27.1 million in first quarter of 2013, contributing 69% of total Sogou.com's revenue. The reason for the upsurge was escalation of Sogou's market share to 7.85% in the search engine market in China. This year, Sogou plans to continue to enhance the functionality of its core products including Sogou Pinyin.

Sogou recently launched the second version, Sogou Pinyin 2.0, a typing tool with new set of features. The new features will offer a user, that searches for a keyword in the input bar, with corresponding search results, automatically displaying below the typing input bar. For example, when a user types in the name of a movie using Sogou Pinyin, the feature will display internet links, which will direct the user to the content without going through the search functionality. This feature converts Pinyin from a pure typing tool to a search tool. In the first quarter of 2013, Sogou Pinyin added 11 million new users, from the previous quarter, and reached a penetration level of more than 88% in the market.

In March, Sogou.com's monthly active users grew by 34% to 123 million from December last year. A major contributor was its core product Pinyin. The new upgrade will help the company attract more users, which will influence the revenue it generates from advertisements on the application. Sogou.com posted $39 million of revenue in the first quarter of 2013, which was down 4% from the earlier quarter. However, looking at Pinyin's increased penetration, the management projected that the subsidiary will experience an increase of 22% - 27% sequential growth. I assume that Sogou.com will perform as per this projection and continue at this pace for the remaining year.

Constant growth in the gaming arm

Changyou.com, another subisdiary of Sohu, is currently engaged in developing and operating massively multiplayer online games, or MMORG. Changyou.com is responsible for approximately 54% of Sohu's online gaming revenue. The subsidiary's more than 50% contribution is due to strong average revenue per user, or ARPU. The ARPU for Changyou.com comes from a massive 77% year-over-year growth to $64.97 in the first quarter of 2013. The reason for this massive growth was the company's player segmentation strategy for its flagship game Tian Long Ba Bu, or TLBB. Under this strategy, it provided different game features for advanced high paying users and low paying casual users. Looking at this performance, the company launched an expansion pack for TLBB on April 25, 2013 and expects to launch its annual expansion pack in the second half of this year.

Additionally, the product pipeline for Changyou.com has more launches this year as it is eyeing the mobile gaming space in China. Changyou.com plans to launch Xuanyuan Sword 6 and two licensed games including Grand Chase, a Japanese anime-style MMORG, in the second half of this year. Focusing on mobile gaming space, iResearch China stated that the Chinese mobile game enterprises generated revenue of $1.43 billion in 2012. The strong growth rate of 53.1% will guide the revenue generated from the same to $2.18 billion in this year. In line with this growth, the company is planning to launch two mobile games this year. Changyou.com's team of over 200 gaming engineers, including both internal employees and outside mobile industry professionals, is developing free-to-play mobile games. These mobile games will cater to the rising number of mobile gamers in China, which will reach 360 million in 2014 from 215 million users in 2012. The company has an excellent opportunity to generate revenue from the rising number of mobile users. This will help the online gaming segment to produce $709 million in the fiscal year 2013 compared to $575 million in the previous fiscal year.

Sohu's comparison to its peers for total past returns to investors and its revenue generating business segments are representing a potential upside in the performance. However, is this enough to form a positive view of the company? The answer is definitely ''NO''. I have analyzed some of the factors that can act as a speed bump on its road to success.

Sustained cost pressure

This year will be an investment year for Sohu. Online video content prices have stabilized 20% - 30% since 2012, where per episode cost was around $81,000. Inversely, Sohu will continue to ramp up the investment of video content. The increase in content investment is due to the free TV dramas that are still the most powerful source to attract higher rates of online viewers. The investment activities will most likely offset the decline in prices of video content. I also expect a spike in content costs in the third quarter of 2013 due to the beginning of the new season of Voice of China 2.

Furthermore, Sogou.com will have to hike investments to compete with Qihoo 360 Technology, which is Sogou.com's competitor in the search engine business. However, the investment strategy may not work for Sogou.com as it has a market share of 7.85%, as discussed earlier, compared to Qihoo's second postion of 12.36%. It will also increase its investment activities in the marketing of its recently launched core product, Pinyin.

In addition, mobile usage in China has surged significantly over the past six to 12 months for Sohu, especially in online video. The reason for this is a rise in the number of mobile subscriptions in China, reaching 1.17 billion subscribers in May 2013, a 12% year-over-year growth. Because of this, the company will likely see higher bandwidth costs from increased traffic in 2013 that will have a negative impact on its bottom-line. Sohu will start monetizing its online videos with mobile advertisements in the second half of this year. Despite lower-quality video on mobile versus desktop, mobile video compression technology is not yet as advanced as that of desktop, resulting in higher bandwidth costs.

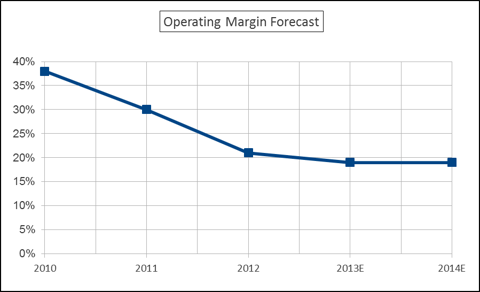

All of these activities will negatively affect the operating margin for the company. I assume the operating expenses for this year will rise to $586 million, compared to $474 in the prior year. This will directly affect the operating margin for the company, which was 21% for the fiscal year 2012. Based on increased expenses in various business segments, the operating margin will drop by more than 9% to 19% in the current year.

(click to enlarge)

Conclusion

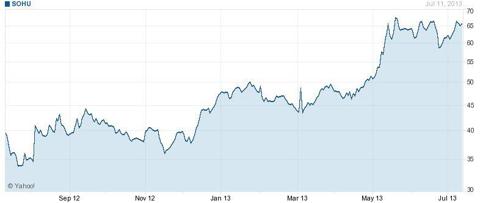

Looking at Sohu's past year performance of the stock price, it has been trading between $33.75 and $68.58. It reached its 52-week high of $68.58 on May 20, 2013. The company's robust performances in various business segments during the year contributed to this upside. The management's intimation about the launch of the second version of its core product, Pinyin, was one of the reasons for major upside as well as the product pipeline for Changyou.com and heavy monetizing opportunities.

(click to enlarge)

Source: Yahoo! Finance

I assume the investors have already discounted all these factors, resulting in the upside movement on the stock. Considering this, I conclude that the stock price will trade at the current levels for this year.

Therefore, I recommend a hold on this stock.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: http://seekingalpha.com/article/1547612-what-to-do-about-sohu?source=feed

paleo diet paleo diet earth day Luis Suarez Earth Day 2013 westboro baptist church meteor shower

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন